Every year, American drivers experience a predictable frustration: gasoline prices climb as Memorial Day approaches

and remain elevated throughout summer, only to decline as Labor Day passes. This seasonal pattern feels almost like

a conspiracy against vacation budgets, with oil companies seemingly exploiting the moment when families hit the road

for summer trips. The reality is more complex and rooted in fundamental supply and demand dynamics that recur

annually with remarkable consistency. Understanding why gasoline prices spike every summer—the interplay of

increased demand, reduced supply, regulatory fuel switches, and refinery economics—reveals a pattern that savvy

consumers can anticipate and partially mitigate through timing and planning. The summer driving season represents

one of the most predictable pricing cycles in the American economy, yet it catches many consumers off guard year

after year.

The Demand Surge Explained

Summer gasoline consumption in the United States runs roughly 10-15% higher than winter levels. This demand increase

results from vacation travel, longer days encouraging more driving, and reduced heating fuel competition for

refinery capacity.

American driving patterns show a clear seasonal arc. Vehicle miles traveled peak in July and August when school is

out, vacations overlap, and weather encourages trips to beaches, national parks, and family gatherings. This

additional driving translates directly into increased gasoline combustion.

The Numbers Behind Summer Driving

The U.S. Energy Information Administration tracks gasoline consumption closely. Summer months regularly see demand

exceeding 9 million barrels per day, compared to winter lows around 8 million barrels. This roughly 1-million-barrel

daily difference sounds modest but represents a significant swing for a market that balances supply and demand

tightly.

Holiday weekends create demand spikes within the summer pattern. Memorial Day, the Fourth of July, and Labor Day

weekends see particular volume increases as millions simultaneously fill tanks for road trips.

Refinery Capacity Constraints

Refinery capacity to produce gasoline doesn’t expand when summer arrives. The same facilities serving winter demand

must now meet elevated summer needs. This capacity constraint—insufficient production versus demand—is the

fundamental driver of summer price increases.

U.S. refineries typically run at 85-95% utilization rates, with summer rates at the higher end of this range. When

operating near maximum capacity, any disruption—unplanned maintenance, equipment failure, weather impact—immediately

tightens supply and spikes prices.

The Spring Turnaround Problem

Refineries require periodic maintenance that takes units offline for weeks. This maintenance, called “turnarounds,”

is typically scheduled for spring and fall when demand is lowest and fuel formulation changes occur anyway.

The problem arises when turnarounds run long or coincide with unexpected outages. Reduced capacity precisely as

summer demand ramps creates supply tightness. Refineries returning from maintenance just as demand peaks can leave

briefly inadequate production.

Summer Fuel Formulation Requirements

Environmental regulations require different gasoline formulations for summer and winter. Summer blends evaporate

less readily, reducing emissions of volatile organic compounds that contribute to smog. These formulations are more

expensive to produce and limit supply flexibility.

The summer gasoline specification, known as “summer-grade RFG” (reformulated gasoline), restricts Reid Vapor

Pressure (RVP)—a measure of how readily fuel evaporates. Lower vapor pressure reduces evaporative emissions but

requires different refinery processing and blend components.

The Transition Challenge

The switchover to summer-grade gasoline occurs in spring, with deadlines varying by region. Refineries must complete

fuel specification changes and bulk terminals must turnover inventory. This transition process reduces supply

availability precisely as demand begins climbing.

Regional fuel specifications compound the challenge. California, various metropolitan areas, and other regions

require specific gasoline blends. A shortage in one area cannot be easily solved by shipping fuel from another area

if specifications differ.

| Factor | Winter Season | Summer Season |

|---|---|---|

| Gasoline Demand | ~8.0 million bpd | ~9.2 million bpd |

| Fuel Formulation | Higher RVP (cheaper) | Lower RVP (more expensive) |

| Refinery Capacity | Post-maintenance, available | Maximum utilization |

| Inventory Levels | Often building | Drawing down |

| Price Tendency | Lower, stable | Higher, volatile |

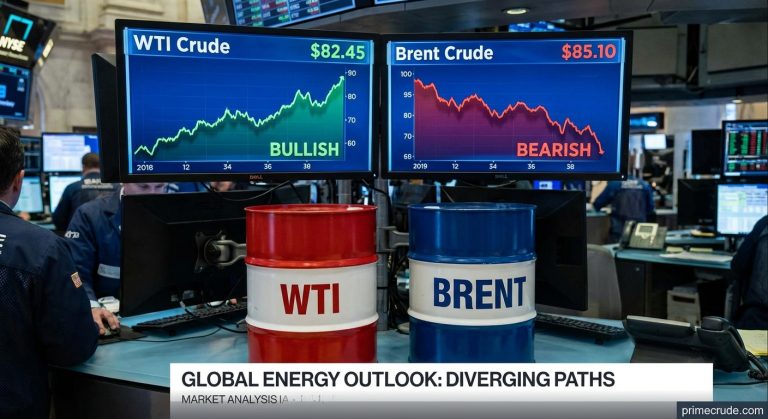

The Role of Crude Oil Prices

Crude oil is the primary input to gasoline, so underlying oil prices significantly influence what you pay at the

pump. Summer crude prices don’t necessarily run higher than winter, but any crude price increase during peak demand

season amplifies gasoline impact.

The “crack spread”—the difference between crude oil input cost and refined product value—tends to widen during

summer. Refiners earn more per barrel processed when demand is strong. This margin expansion reflects supply-demand

balance for refined products specifically, separate from crude oil dynamics.

Global Factors Affecting Crude

Crude oil prices respond to global supply and demand, with summer driving season primarily an American phenomenon.

However, the Northern Hemisphere broadly experiences increased transportation fuel demand during summer months, with

European and Asian vacation travel adding to global gasoline demand.

OPEC production decisions, geopolitical tensions, and economic developments affect crude prices regardless of

season. A summer coinciding with supply disruption or OPEC cuts compounds seasonal price increases.

Regional Price Variations

Gasoline prices vary significantly by region, reflecting local taxes, specific fuel requirements, and distribution

logistics. Some regions experience more dramatic summer spikes than others.

California consistently posts the highest gasoline prices in the continental United States, with summer prices often

exceeding other regions by $1.00 or more per gallon. Unique fuel requirements, limited refining capacity for

California specifications, and high state taxes all contribute.

The Midwest Factor

Midwest states can experience dramatic price spikes when regional refinery problems coincide with summer demand. The

region’s relative isolation from coastal supply options means local outages have outsized impacts.

Great Lakes states requiring specialized fuel blends face particular vulnerability. A refinery problem in Chicago

can’t be solved by shipping fuel from Texas if specifications don’t match.

Historical Summer Price Patterns

Looking at historical data confirms the predictability of summer price increases. Gasoline prices rise from January

through June in most years, with peaks typically occurring between May and July.

The magnitude of summer increases varies based on underlying crude oil prices and specific circumstances. Some years

see relatively modest increases of $0.30-0.40 per gallon; others experience run-ups exceeding $0.75 per gallon

during periods of crude price inflation.

Record Summer Prices

The summers of 2008 and 2022 saw record-high gasoline prices, with national averages exceeding $5.00 per gallon in

some weeks. These extremes resulted from crude oil price spikes coinciding with normal summer demand

patterns—worst-case combinations of global and seasonal factors.

More typical summers see increases of $0.40-0.60 per gallon from winter lows to summer peaks. This consistent

pattern provides a predictable baseline even when specific prices vary with crude oil market conditions.

Consumer Strategies for Summer

Understanding the seasonal pattern allows consumers to make informed decisions about fuel purchases and travel

timing. While you can’t avoid summer prices entirely, some strategies help.

Filling up before Memorial Day, when prices typically haven’t reached summer peaks, saves money for early summer

travel. Prices often climb through June, so earlier vacation travel may cost less in fuel.

Fuel Price Tracking Apps

Apps like GasBuddy aggregate user-reported prices, identifying the cheapest stations in your area. Price variations

of $0.20-0.40 per gallon between nearby stations are common, making a few minutes of research worthwhile.

Wholesale club memberships (Costco, Sam’s Club, BJ’s) typically offer gasoline at $0.10-0.30 per gallon below

conventional stations. For frequent drivers, membership costs are often recovered through fuel savings alone.

Timing Travel

If your schedule allows flexibility, traveling before Memorial Day or after Labor Day typically means lower fuel

costs. This approach works best for retirees and others without school-age children, who face more scheduling

constraints.

Even within summer, avoiding travel on peak holiday weekends can reduce fuel costs—though the savings come partly

from avoiding premium prices charged when demand surges.

The Oil Industry Perspective

Oil companies and refiners often face accusations of price gouging during summer months. Industry representatives

counter that prices reflect genuine supply-demand dynamics rather than exploitation.

Refinery margins do expand during summer, but this reflects competitive pricing in a market where capacity is

constrained. Individual companies don’t control prices—markets set them based on available supply versus willing

buyers.

Capital Constraints on Capacity

One might ask why refiners don’t build more capacity to meet summer demand. The answer involves capital economics:

building refinery capacity that sits idle most of the year doesn’t generate returns justifying the investment.

U.S. refining capacity has actually declined slightly in recent years as older facilities close without replacement.

Environmental regulations, uncertain long-term demand due to electric vehicles, and challenging project economics

discourage new construction.

Future Trends Affecting Summer Prices

Several factors may affect future summer gasoline price dynamics. Electric vehicle adoption reduces gasoline demand

growth, potentially moderating future summer spikes. However, refinery closures may offset this effect by reducing

supply.

Climate change could affect driving patterns, though the direction is uncertain. Extreme heat might reduce some

summer travel while extending the comfortable driving season. More Atlantic hurricanes could disrupt Gulf Coast

refining during peak season.

Policy Changes

Federal and state policies affect gasoline markets in various ways. Waivers of summer fuel requirements during price

spikes can temporarily ease supply. State tax policies and fuel specifications evolve based on political and

environmental priorities.

Strategic Petroleum Reserve releases have occasionally tempered price increases, though SPR use for price management

remains politically contentious. The depleted reserves following 2022 releases limit this tool’s future

availability.

Conclusion

Summer gasoline price increases reflect the predictable interaction of elevated demand, constrained refinery

capacity, mandated fuel formulation changes, and routine maintenance schedules. This pattern recurs annually with

remarkable consistency, yet catches many consumers by surprise.

Understanding the underlying dynamics helps contextualize prices that might otherwise seem like arbitrary

exploitation. Refineries don’t choose to charge more in summer—market forces establish prices based on supply and

demand that genuinely differ seasonally.

Consumers can partially mitigate summer fuel costs through strategic timing, comparison shopping, and membership

programs. Those with scheduling flexibility benefit most from planning around predictable price patterns.

The annual summer gasoline price spike is one of the economy’s most predictable patterns—understanding why it

happens every year provides context for the frustration every driver feels at the pump.

📋 Educational Disclaimer

This article is provided for educational and informational purposes only. It does not constitute financial,

investment, or professional advice. Energy markets are complex and volatile.

Before making any investment or trading decisions, consult with qualified financial advisors who understand your

specific situation and risk tolerance. Past market performance does not guarantee future results.

The information presented here is general in nature and may not be suitable for your particular circumstances.