Every financial news broadcast mentions oil prices, but which prices exactly? Two names dominate the conversation:

West Texas Intermediate (WTI) and Brent crude. These benchmarks represent more than just different oil grades—they

serve as the foundation for pricing billions of barrels of crude oil traded globally each year. Understanding the

difference between WTI and Brent reveals how the physical oil you pump into your car connects to abstract financial

instruments traded by speculators thousands of miles from any oil well. For American consumers, the relationship

between these benchmarks and retail gasoline prices matters enormously, even though most people couldn’t explain why

Brent trades a few dollars above or below WTI on any given day. This pricing structure determines not just what you

pay at the pump but also which oil gets produced, transported, and refined to meet global demand.

What Are Oil Benchmarks?

Not all crude oil is identical. Thousands of different crude grades exist worldwide, varying in density, sulfur

content, and other characteristics that affect their value to refiners. Pricing each grade individually would be

impractical, so the industry uses benchmarks—representative grades that serve as reference points for pricing other

crudes.

Benchmarks must be widely traded with transparent pricing, represent significant production volumes, and have

characteristics that make them useful reference points. WTI and Brent have emerged as the world’s two dominant

benchmarks, with most global crude oil priced in relation to one or the other.

The Role of Futures Markets

Benchmark pricing occurs through futures markets where standardized contracts trade on exchanges. The NYMEX WTI

contract represents 1,000 barrels of West Texas Intermediate crude deliverable at Cushing, Oklahoma. The ICE Brent

contract represents North Sea Brent crude, settled financially rather than through physical delivery.

These futures contracts trade continuously, establishing real-time prices that serve as references for physical oil

transactions worldwide. The prices quoted on financial news represent these benchmark futures rather than any

physical oil changing hands.

West Texas Intermediate Explained

WTI is a light, sweet (low sulfur) crude oil produced primarily in Texas and the American Southwest. Its

characteristics—around 39 API gravity and 0.24% sulfur content—make it an excellent refinery feedstock, particularly

for producing gasoline.

The benchmark delivery point at Cushing, Oklahoma reflects historical pipeline infrastructure that made this

crossroads town the logical aggregation point for mid-continent crude. Massive tank farms at Cushing store oil

awaiting shipment to refineries, with inventory levels closely watched as indicators of supply-demand balance.

WTI’s American Focus

WTI primarily reflects American oil market conditions. U.S. production, refinery demand, pipeline capacities, and

storage levels all influence WTI prices. For decades, export restrictions kept WTI largely an internal American

price signal, disconnected from global markets.

The lifting of U.S. crude export restrictions in 2015 connected WTI more directly to global markets. American crude

now ships worldwide, but infrastructure constraints mean WTI doesn’t perfectly track global supply and demand.

Cushing inventory remains the key indicator.

Brent Crude Explained

Brent originated as production from the Brent oil field in the North Sea between Scotland and Norway. Today, the

benchmark actually represents a blend of crude from several North Sea fields, as original Brent production has

declined substantially.

Brent qualities—approximately 38 API gravity and 0.37% sulfur—are slightly heavier and more sulfurous than WTI but

still considered light, sweet crude. These characteristics make Brent suitable as a global benchmark for pricing

similar crudes worldwide.

Brent’s Global Role

Despite originating from relatively small North Sea fields, Brent serves as the pricing reference for roughly

two-thirds of global crude oil trade. African crudes, Middle Eastern exports, and many Asian grades price relative

to Brent. This de facto global standard emerged from the North Sea’s transparent market structure and waterborne

delivery that avoids landlocked transportation constraints.

Brent futures trade on the Intercontinental Exchange (ICE), with prices reflecting global supply-demand balance more

directly than the American-focused WTI. When headlines mention “oil prices” without specification, Brent is often

the reference.

| Characteristic | WTI (West Texas Intermediate) | Brent Crude |

|---|---|---|

| Origin | Texas/American Southwest | North Sea (multiple fields) |

| API Gravity | ~39 (lighter) | ~38 (slightly heavier) |

| Sulfur Content | ~0.24% (sweeter) | ~0.37% (slightly more sour) |

| Primary Exchange | NYMEX (CME Group) | ICE |

| Delivery/Settlement | Physical at Cushing, OK | Cash settlement |

| Global Pricing Role | ~33% of global crude | ~67% of global crude |

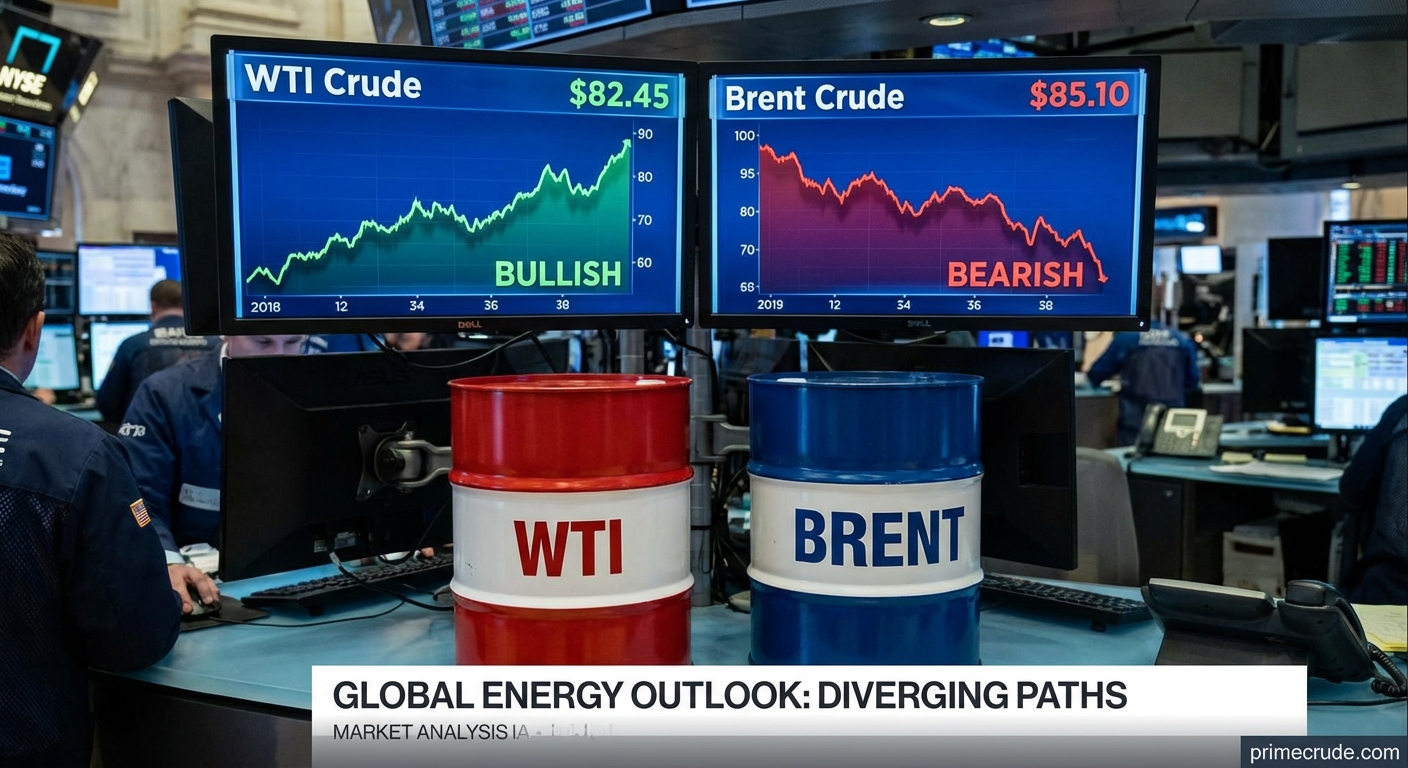

Why Prices Differ: The Spread

WTI and Brent rarely trade at identical prices. The difference—called the “spread”—fluctuates based on supply-demand

conditions specific to each market. Understanding what drives the spread reveals how oil markets actually function.

Transportation costs establish a theoretical relationship. Moving oil from the U.S. to international markets incurs

shipping costs that should keep WTI at a discount to Brent equivalent to transportation expense. In practice,

infrastructure constraints, storage dynamics, and market conditions create more volatile spread behavior.

Historical Spread Patterns

Before 2011, WTI typically traded at a modest premium to Brent, reflecting its lighter, sweeter quality. The shale

revolution then flooded Cushing with oil faster than pipelines could remove it, causing WTI to collapse to $20+

discounts versus Brent.

Pipeline construction eventually relieved Cushing congestion, normalizing spreads. Recent years have seen WTI trade

at modest discounts of $2-5 versus Brent, reflecting transportation costs and quality differences.

Which Benchmark Affects Your Gas Price?

American consumers might assume their gasoline prices reflect WTI, the domestic benchmark. The actual relationship

is more complex and varies by location.

Refineries purchase crude from various sources, blending different grades to optimize operations. A Gulf Coast

refinery might process WTI-priced domestic crude alongside Brent-priced imports. The marginal barrel—the last one

needed to meet demand—determines pricing, and that marginal barrel might come from anywhere.

Refining and Distribution

The gasoline you purchase results from crude oil plus refining costs, distribution expenses, taxes, and retail

margins. Crude represents roughly 50-60% of retail gasoline price in normal conditions. Both benchmarks influence

crude costs depending on refinery sourcing.

East Coast refineries historically relied more on imported crude, making Brent more directly relevant. Gulf Coast

refineries process diverse slates including both domestic and imported crudes. California’s unique market conditions

and regulations create distinct pricing dynamics.

The Relationship Between Benchmarks

Despite different delivery points and trading venues, WTI and Brent prices show strong correlation. Global oil

markets are connected enough that major price moves in one benchmark quickly spread to the other. The spread

adjusts, but both benchmarks follow similar overall trends.

Global events affecting overall oil supply or demand move both benchmarks similarly. OPEC production decisions,

major economic developments, and geopolitical disruptions influence both prices. The spread changes based on factors

affecting one market more than the other.

Spread Trading Opportunities

Professional traders actively trade the WTI-Brent spread, betting on whether the gap will widen or narrow rather

than on absolute price direction. This spread trading requires understanding the specific factors driving each

market—a specialized expertise distinct from broader oil price forecasting.

Spread trades can profit regardless of whether oil prices rise or fall, as long as the relationship between

benchmarks moves as expected. This makes spread trading attractive for those with insight into particular market

dynamics.

Other Important Benchmarks

While WTI and Brent dominate, other benchmarks serve specific regional markets or crude types. Understanding the

broader benchmark landscape provides context for the global oil pricing system.

Dubai/Oman crude serves as the benchmark for Middle Eastern exports to Asia. This heavier, more sour grade reflects

the characteristics of Persian Gulf production and Asian refinery demand. Most Middle Eastern crude pricing

references Dubai.

Regional and Specialty Benchmarks

Louisiana Light Sweet (LLS) prices Gulf Coast domestic production, trading at premiums or discounts to WTI based on

regional conditions. Mars Blend represents heavier Gulf of Mexico production.

Canadian heavy crude benchmarks like Western Canadian Select (WCS) price oil sands production at substantial

discounts to light sweet grades, reflecting quality differences and transportation constraints that have plagued

Canadian exports.

The Evolution of Benchmarks

Oil benchmarks aren’t static—they evolve as production patterns change and markets develop. Brent itself has

transformed from a specific North Sea grade to a basket of crudes as original field production declined.

The rise of U.S. tight oil production has reinforced WTI’s importance while also creating new domestic benchmarks

for Permian or Bakken crudes. Export growth is connecting American pricing more closely to global markets.

Chinese and Asian Alternatives

China has attempted to establish yuan-denominated oil benchmarks through the Shanghai International Energy Exchange.

While these contracts haven’t displaced dollar-based WTI and Brent, growing Asian demand may eventually shift

pricing power eastward.

The geopolitics of benchmark dominance matters because dollar-based oil pricing reinforces American financial

influence. Alternative benchmarks could shift this advantage, motivating U.S. interest in maintaining current

structures.

For Investors and Consumers

Investors accessing oil exposure through ETFs or futures should understand which benchmark they’re trading. Popular

WTI-based products like USO track American oil prices; Brent-based products reflect global conditions more directly.

For most American consumers, the specific benchmark matters less than overall oil price levels. Both WTI and Brent

move together on major market events. The spread differences of a few dollars per barrel translate to cents per

gallon at the pump—noticeable but not transformative.

Reading Oil Price News

Financial news often references “oil prices” without specifying which benchmark. Context usually clarifies: American

production stories typically mean WTI; global supply or OPEC stories usually mean Brent. Checking the actual

contract quoted avoids confusion.

Price forecasts from analysts likewise specify benchmarks. A prediction that “oil will reach $100” means different

things for WTI versus Brent. The spread between benchmarks affects the translation.

Conclusion

WTI and Brent oil benchmarks serve as the foundation for pricing most of the world’s crude oil. WTI reflects

American market conditions with physical delivery at Cushing, Oklahoma. Brent serves as the global benchmark for

international trade, reflecting worldwide supply and demand.

Both benchmarks influence what American consumers pay for gasoline, with the relative importance depending on

refinery sourcing and geographic location. The spread between benchmarks fluctuates based on factors like

transportation costs, infrastructure constraints, and regional supply-demand conditions.

Understanding these benchmarks provides context for oil price movements that otherwise seem disconnected from daily

experience. When news reports price changes, knowing which benchmark is referenced helps interpret the implications.

The prices flashing across trading screens in New York and London—WTI and Brent—determine what you pay at the

pump, connecting global commodity markets to the most common consumer transaction in America.

📋 Educational Disclaimer

This article is provided for educational and informational purposes only. It does not constitute financial,

investment, or professional advice. Energy markets are complex and volatile.

Before making any investment or trading decisions, consult with qualified financial advisors who understand your

specific situation and risk tolerance. Past market performance does not guarantee future results.

The information presented here is general in nature and may not be suitable for your particular circumstances.